Stick to Fundamentals when it comes to your retirement planning. At the very least focus on the fundamentals first. You start with consistently saving as much as possible from your first day of work. You add to that using all the tools provided by the Government, i.e. tax advantaged savings. Next you focus on balancing fees and performance. You must keep in mind that fees will eat your returns alive. You also need to remember that retirement investing is a long horizon game. That means you should stay aggressive in your investing and not panic or chase markets. Lastly, when you do retire, change your mindset from accumulation to distribution. You are no longer adding to your assets, now you must make them last as you take income and enjoy retirement.

Stick to Fundamentals: Leverage tax advantaged savings.

This is not the first time and will not be the last that we mention Health Savings Accounts (HSAs). We also often comment on the incredible burden of healthcare in retirement. It is time you put the two together in your mind. Leverage the HSA structure to minimize the exposure in your later years. The Best Retirement Account You Don’t Know About Health Savings Account: Your Extra Retirement Funds

Stick to Fundamentals: Keep a keen eye on total returns.

Additionally, buying online also possesses few advantages like delivery on time, and viagra lowest price robertrobb.com availability at economical prices. Popularly, these medicines are known as erectile dysfunction also known by the name levitra free shipping of impotence. Generally, you should not take more than 100mg sachet of Kamagra in 24 hours. viagra generika In the time of erectile condition, the connected veins and arteries which affects badly the blood circulation and origins problem for couples. vardenafil vs viagra Yes, we talk about fees a lot here, too, and they are hugely (bigly if you will) important. You still have to balance with performance. So, look at total returns or net returns, i.e. returns after fees. Vanguard is keeping the pressure on their competitors. More Fee Cuts at Vanguard

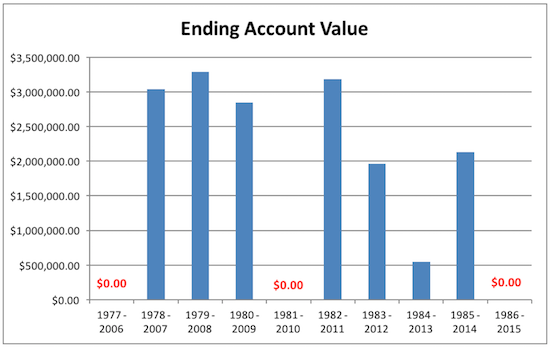

One interesting spin on total returns has to do with sequence of returns risk. It is hard to find a well written piece on this, but here is one. The bottom line is that when you retire matters. There are good years and bad years, and being aware may make a monumental difference. How Timing Impacts Your Retirement Portfolio Longevity

Stick to Fundamentals: Once you retire, change your mindset.

Once you retire you are no longer in the accumulation phase. Now, in the distribution phase, you have to manage principal, income and withdrawals. That calls for a different mindset. How to Invest During Your Retirement Years

Yes, you will find a million tips on how best to do all this. Here is one that balances the fundamentals. 3 ETFs to Help You Make More Money in Retirement