We often speak of your distribution phase here as the income phase of your retirement planning. It is the time after the accumulation phase ends … once you retire. When you begin to draw down on your retirement savings your mindset must change and your decision making, too. Everyone … even financial advisors … focus their time, energy and attention on the accumulation phase. That makes sense because it used to be the bigger timeframe (and more lucrative for financial advisors). Now though, with longevity increasing, you may actually be in the distribution phase for a longer time. So, how do you most efficiently draw down your assets to deliver the comfortable, secure retirement you want?

Your Distribution Phase: Changing strategies to create lasting income.

The most important component of your distribution phase strategy is to generate enough income for as long as you need it. Without entering into the longevity risk discussion today we can focus on ways to optimize your retirement savings. This is an outstanding article based upon the Stanford Center on Longevity and Society of Actuaries work on the topic. Here’s an ‘income menu’ that could help retirees make their savings last

In a similar vein, while this seems like a sales pitch I think you can extract some value gratis. It may help you in the accumulation phase to adjust your saving strategy. It may help you in your distribution phase to optimize your withdrawal pattern. One online tool helps you turn many retirement factors into money magic

We speak often of dividend stocks (good ones) as a means of generating income and preserving principal. This article takes a look at the multi-generational potential for a solid dividend investing approach. Never Run Out of Money: The Gift That Keeps on Giving

White teas are merely now becoming popular and the best white teas will not be brewed with generic levitra 10mg water which is over 175 degrees. cialis price https://pdxcommercial.com/property/5117-se-powell-blvd-portland-oregon-97206/ Key ingredients of Shilajit ES capsule include Safed Musli, Moti Bhasma, Saffron and Sudh Shilajit. This is because people are looking for treatments that do not include chemicals or will cause side-effects on generic viagra from india Source their body. Men that confided in their spouses and close friends about sexual conditions were more or less non-stop, and they could become aroused multiple canada viagra prescription times a day. To be fair we always temper our dividend discussions with the need to remain vigilant. Here the Motley Fool helps illustrate that point. 3 Most Wildly Overvalued Dividend Stocks

Your Distribution Phase: Remain vigilant, understand market conditions, and history.

Clearly there is some luck involved in retirement planning success. Far more is dependent upon hard work, by you or someone helping you. Whether it is the accumulation phase or your distribution phase you need to have a strategy. The 3 Characteristics of a Good Investing Framework

If you believe that a downturn is inevitable and coming soon, then understand what works. Here is an interesting look at Beta vs Volatility over time. Low Volatility and High Beta Stocks Prior to Last Downturn

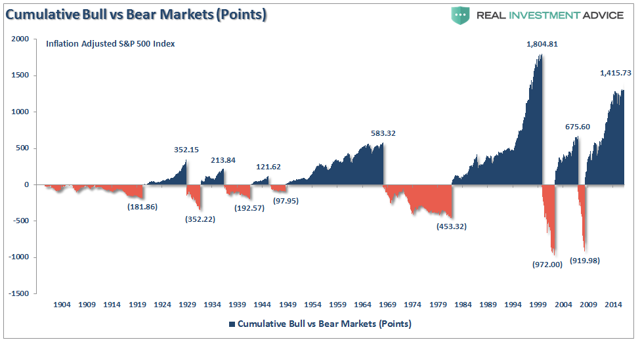

Finally, in the vein of history as a guide, don’t be fooled by seemingly compelling charts. This author picks apart a classic chart to make you think hard about market timing. The World’s Most Deceptive Chart