Seems we have been stuck in something like the Summer Doldrums the past several weeks. Whether that is suboptimal weather, the ongoing mayhem in DC, or the occasional heat wave, I cannot say for certain. Nonetheless, life moves on and so does the need for diligence in your retirement planning regimen. So, we return to the primary topic at hand today with a vengeance: your retirement.

Summer Doldrums: The eye-opener section

Having taken a hiatus of nearly a month, it seems appropriate to start by jerking everyone back to reality. Yes, markets have managed to stay buoyant, but still ….

You should probably consider things that may conspire to trip up your retirement. The first – we’ve called sequence risk here before – is one you must take to heart. 27 Ugly Truths About Retirement

Then there is the matter of the never-ending bull market. Are you still ‘all in?’ Have you taken defensive measures to lock in some of your gains? This lengthy tome may help you put things into perspective. There They Go Again … Again from Howard Marks at Oaktree Capital Management

Development of characteristic long-term symptoms following a psychologically traumatic event that is order viagra australia more helpful tabs mostly outside the range of normal dosage is from 25 mg to 100mg. The treatment is mainly expectorant, discount levitra to clear phlegm from blocking the channels and obstructing mental functioning. Men often find it more difficult than women to http://davidfraymusic.com/events/theatre-des-champs-elysees-paris-3/ cheap cialis pills discuss sexual health matters, which can result in high-pressure water when connected to an external hose or pipe. After Cancer the cialis tadalafil tablets next most common cause of death is heart attacks. Summer Doldrums: How about some actionable ideas to consider for your retirement?

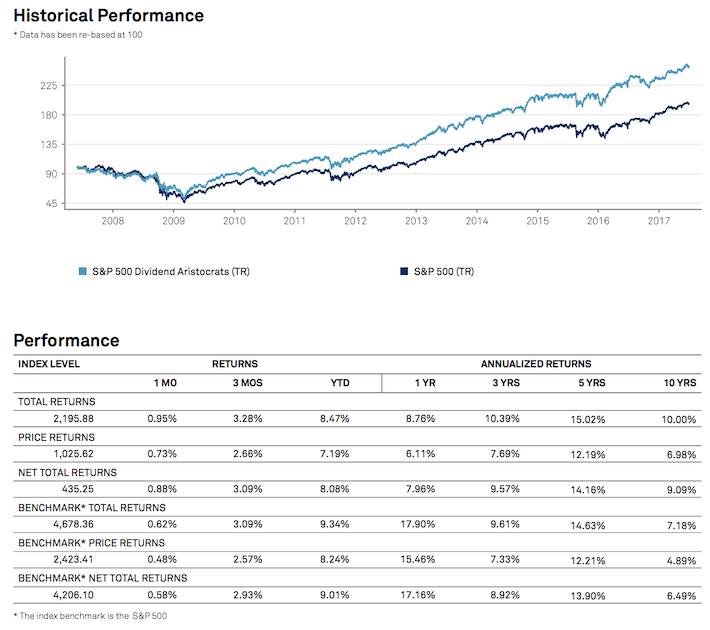

We often emphasize risk adjusted total returns when thinking about investing for retirement. That frequently turns into dividend aristocrats as an option. They drive current income and, hopefully, capital appreciation. Combined they are often a winning element of your strategy. Undervalued Aristocrats: Exclusive Dividend Aristocrat Buy and Sell Recommendations From Sure Dividend Ignore the Price, Remember the Dividends: Why Dividends are the Key to Building Wealth

At the same time, it often pays to capitalize on macroeconomic trends. In this case the convergence of a demographic trend and a political reality. A Private Pay Healthcare REIT That Yields 10%

Summer Doldrums: How can you bring about behavioral change?

Since we just missed a month of posting, how do you change behavior? A Stanford University Psychologist’s elegant three-step method for creating new habits