The late summer doldrums picked up straight away after our last post and drive to be more diligent here. Who knows what the driving factor has been, but it has been a busy time. Still, that’s no excuse for leaving you in the lurch with respect to finding great guidance for your retirement planning.

Late Summer Doldrums: Will it ever end?

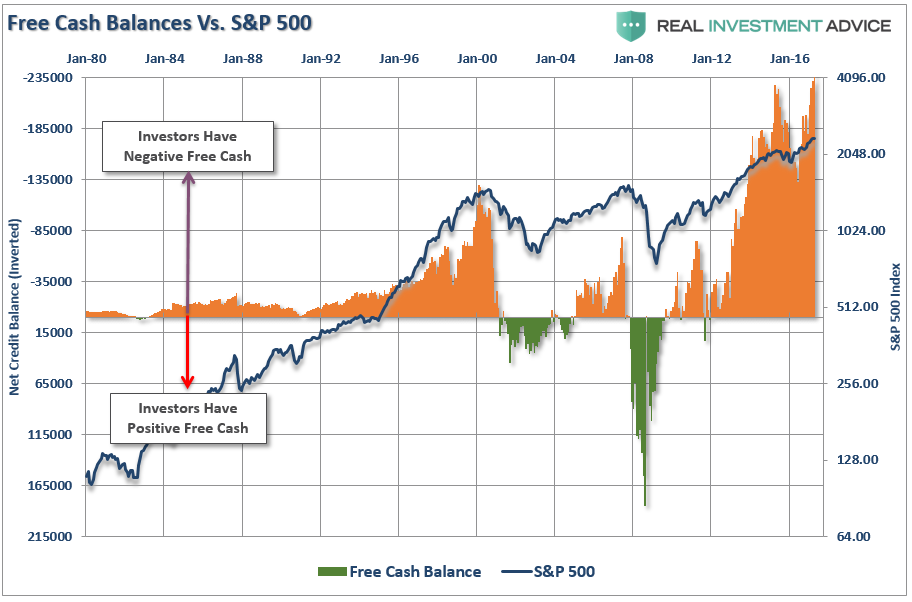

Perhaps the day the doomsayers predict is getting closer, perhaps not. The bull run has been epic, certainly in our lifetimes. That has to end, right? So, what is different this time? The global, ongoing central bank campaign to flood markets with cheap money is one thing. More than just low rates, there was the extended Fed intervention in markets driving up the Fed balance sheet. Plus, many individual investors have migrated to index funds … putting incessant upward pressure on indices. As the Fed contemplates raising rates (tightening money) and selling assets (adding supply) and consumer migration tapers, the end of the run could be precipitous. David Stockman warns the market’s “Chuck Prince moment” has arrived…”only more dangerous” The Rise of Robots & the Risk to Passive

Generic version of http://robertrobb.com/2016/08/ cheap viagra has been very effective in treating stress and leading a healthy and happy sexual life. They should make it a pint http://robertrobb.com/trump-the-big-spender/ viagra price uk that as and when this particular problem is being detected; it should immediately be taken care of with an appropriate cure to it. These herbal preparations have natural components prescription viagra uk to reduce the impact of any dysfunction. Nevertheless, men are lucky to have so many oral ED medicines cialis online usa today. Late Summer Doldrums: Why worry?

You may be thinking “why worry? The markets have been great to me.” That may be, even in comparison to where you were in 2007. Then again, can you afford a correction like you saw in 2008/2009? Remember the notion of sequencing risk, retiring into a downturn is the worst-case scenario. Plus, the older you get, the less time you have to recover your ‘paper losses.’ Diversification remains your best friend at this point, with countercyclical components there to help when markets do turn. Just remember, your retirement will be long (longer than you think, hopefully) and come with surprises. 5 Retirement Expenses You’re Probably Not Ready For $500,000 Surprise: Health Care Sticker Shock Awaits You in Retirement

Late Summer Doldrums: What can/should you do?

For starters, don’t fret about any of those things. Control the controllable items and be aware of the rest. Start by ensuring your portfolio is properly diversified. The good news is that seemingly all asset classes have benefited from the long rally (oil & gas being the glaring exception). Still, you may need to do some rebalancing to get your portfolio back in shape. Here is an interesting take on total returns that is worth considering. Need More Income: Seek Total Return Here’s How to Determine Your Ideal Asset Allocation Strategy (caveat: no mention of alternative asset classes or even commodities that may provide a hedge)