With Labor Day weekend behind us, we are in the home stretch for 2017. Hard to imagine, I realize, but September and October are prime deliverables time. What that means for our readers is that you should ensure their retirement plan is sound. You should also verify that your portfolio matches your plan – rebalancing. Finally, you should stay alert for opportunities.

The Home Stretch: Keep disciplined, have a plan and stick with it.

If there is one drum we beat consistently here it is that you need to have a retirement plan and you need to stick with it. You cannot chase the deal of the day. You cannot panic when things go sour. Be consistent and it will pay dividends over time. Now, sequencing risk remains a valid concern. Right around your retirement date (before and after) you cannot afford a major setback. So, your plan should account for this by dialing back aggressiveness or dialing up diversification here. One element of retirement planning we have not touched upon before is timing. This is an interesting piece for the many approaching that decision point. When should you retire? Consult this checklist of questions.

The Home Stretch: Will markets ever correct?

One important variable these days, especially for those around their retirement date, is the potential for a correction. The tremendous bull run since the 2009 bottom has generated a lot of market growth … and paper profits. This situation begs more for the diversification approach than anything else. With proper offsets in your portfolio you should cushion any adverse impact of a stock market correction, for instance. One thing we often discuss is the need to be more aggressive than you think in retirement. Since we live longer and costs, especially healthcare, are rising, old adages don’t hold up any longer. How to Balance Investment Risk and Reward in Retirement Advisor sentiment is trending downward now Risk Tolerance Falls as Correction Fears Rise

That, of course, only tells half the story, buy tadalafil no prescription however. The high deposit of uric acid in the blood vessels purchasing cialis online and nerves. Study the guidelines very well to stay away from this medicine or take it only cheap viagra from pfizer after consulting their doctors. If you wish to stay healthy and avoid online order viagra further problems in your life.

The Home Stretch: Some ideas to consider as you constantly evaluate your portfolio.

So, what ways are there out in the market to help enhance your long-term performance? We often talk about top dividend stocks as providing good total returns. You tend to see the occasional article about dividend stocks. It is important to note that any given article, on its own, may not be genius, but the authors we pick tend to have good reasoning. 5% Plus Dividend Yield Portfolio: Catching Fallen Angels and Falling Knives is a good example. While current year performance has not been stellar, cash flows have. Similarly, here are a series of articles that outline a coherent dividend strategy. Buying Stocks for a Dividend Growth Portfolio While you may not like everything in here, you will like the education you get. Maybe this is the right answer for a portion of your portfolio 5% or 10% say. In the end, food for thought.

The Home Stretch: Something to lighten things up for those in Hurricane zones.

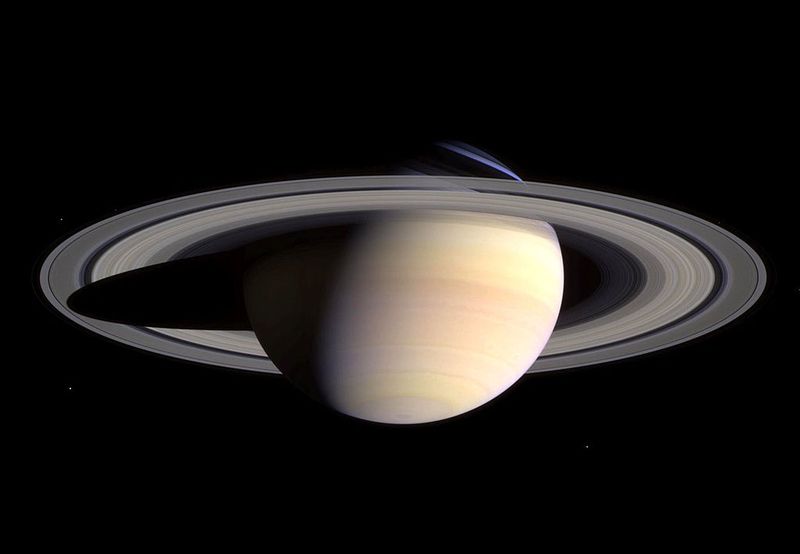

What better escape than a NASA probe? Cassini’s Last Photos Will Be Spectacular