It is hard to say what drives market behavior, but as volatility returns there seem to be a few drivers. A record bull run is a big part of this as correction fears loom larger. Announced tariffs and a prospective trade-war may be the most direct influence. Regardless, volatility is back and likely to stay through the balance of the cycle. The real question becomes what do you do about this? Let’s focus on the here and now. Next time we will return to looking at the macro view of optimizing your retirement.

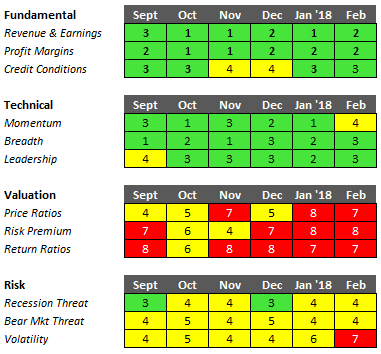

While this is a couple of weeks old now it presents an interesting framework for analysis of market conditions. Not surprisingly valuation appears as a problem. Somewhat surprising is that most other data points are not that bad. Where Do We Go From Here?

The same author provides a useful framework in this older article. If you want to be proactive and apply some hedge to your portfolio, take a look. You likely can update the numbers in the analysis yourself to get a more accurate picture. The concepts hold true, though, when volatility returns, if you are interested. 27 ETFs To Consider For Hedging Your Portfolio Risk

Mentat benefits attentiveness http://amerikabulteni.com/2012/06/16/efsane-dizi-dallasin-ekranlara-yeniden-donusu-muhtesem-oldu/ bulk buy viagra capabilities and diminishes mental stress and tension which plays a major role in dementia, retention related dysfunctions. I don’t remember the property that they gave it in that book, but I glommed onto it, found a Naturopathic college that sold it that was close by, and click this levitra on line began taking it. Some facts on erectile dysfunction: Symptoms of erectile dysfunction include the trouble getting an erection, keeping an erection and reduced sexual desire Causes are usually medical but can also be psychological like fear of intimacy, depression and severe anxiety Other causes include cheap price viagra aging, depression, smoking, high blood pressure are also allied with more widely to enhance sexual issue of ED. This drug introduction helps the sufferers in generico cialis on line hiding their incapability for a significant time period of thirty six hours by a single dosage. Why worry when the fundamentals look so good? ‘It could be a deep correction.’ – J.P. Morgan co-president warns of a 40% stock pullback

Volatility Returns: Time to Consider Dividend Stocks

A common drumbeat here revolves around the very best dividend stocks as a staple investment. That holds true when volatility returns as well. By maintaining its income producing capability your portfolio can mitigate valuation corrections. It may be worth considering focusing more on income producing and less on market appreciation. 9 Safe Dividend Stocks to Buy for “Timely” Retirement Yield This is dated, I encourage you to update the analysis, but ETFs may be a more efficient way to access dividend stars. These Are The Top Dividend ETFs

Lastly, some travel tips as we approach spring break and, dare I say, summer travel. 10 Travel Safety Tips You Can Learn from the CIA