Markets continue to focus on the positive

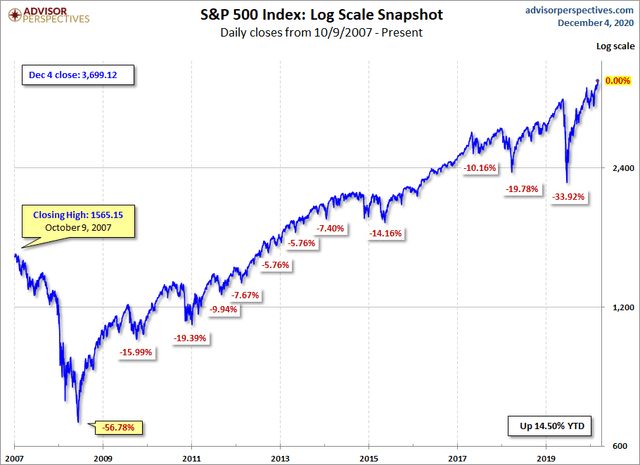

Are the positives overwhelming the negatives? Despite gloomy Covid-19 data in the US and the prospect of more pullbacks and lockdowns associated with it, markets roared last week, many to all-time highs. Positives include the Chinese and Japanese economies are picking up nicely, and Europe perhaps bending the curve again on Covid-19. The Biden presidency is taking shape, with a very likely check from a Republican Senate. The Federal Reserve seems poised to keep stoking the economy, and a new stimulus package is likely before a December 11 Federal Government shutdown. So, in aggregate markets are moving favorably. It brings one back to the fundamental question: does debt matter? Three trillion of Fed spending plus three trillion of Federal deficit spending, with more on the horizon, and we feel good about that? Read what the pundits have to say and decide for yourself.

Weekly Commentary: Money Disorder in Extremis

Weighing the Week Ahead: The State of the Rebound

S&P 500 Weekly Update: Surprise, 5 Major Indices Post All-Time Highs

U.S. Companies are Sitting on the Largest Pile of Cash Ever

Are the positives overwhelming negatives for good?

As an individual investor, you must ask yourself whether this is a temporary bubble or hysteria, or have things fundamentally changed? Theoretically, you can find good investments in either scenario. Indeed, the very same investment may work in either scenario, but they may not. So, understanding the fundamentals and formulating your own opinion, especially about the impact of monetary policy on markets, is really important. Still, we’ll keep looking for solid values for your consideration.

Income Investing

All Weather Dividends: 10 Value Buys and 5 Overvalued Sells to End 2020

Dividend Champion and Contender Highlights: Week of December 6

Invesco Preferred Portfolio ETF: Safety Dance

The 7 Best Bond Funds for Retirement Savers in 2021

Investment Strategy

Rebalancing, Repurposing, Replanning, Remodeling – Let’s Look at Portfolio Adjustments for 2021

It never hurts to revisit last week’s ideas:

Building your knowledge each week

As you can see above, it is an interesting time to be learning about the markets because even the long-term ‘experts’ are somewhat baffled by the disconnect between the economy and the markets. Long held assumptions are being questioned because of the unique and sustained disconnect. Much of this is driven by the behavior of the Federal government, both on the spending side and on the Federal Reserve side. Six trillion Dollars of support for the economy this year, truly unprecedented, and yet markets are eating it up so far. That’s the rub, is it temporary, or permanent? Time will tell, but for now, keep learning.

How to Deal with Stock Market Turmoil: Tips & Tricks on Handling the Ups and Downs

This Crazy Stock Market: A Story Told with Pictures

The U.S. Treasury is the Biggest Investor in the Stock Market. Here’s Why You Should Care.

Investing $400 per Month in This ETF Could Make You a Millionaire by Age 60.