Post-Coronavirus Markets, Back in the Saddle

After a long hiatus building a business, I am pleased to be able to again take the time to curate some select articles for you largely with an investing and retirement focus, but still wandering into technology, travel and other interesting venues, as opportunities present themselves. The first priority is understanding the post-coronavirus markets. I hope you enjoy and benefit from these insights.

What to make of the markets?

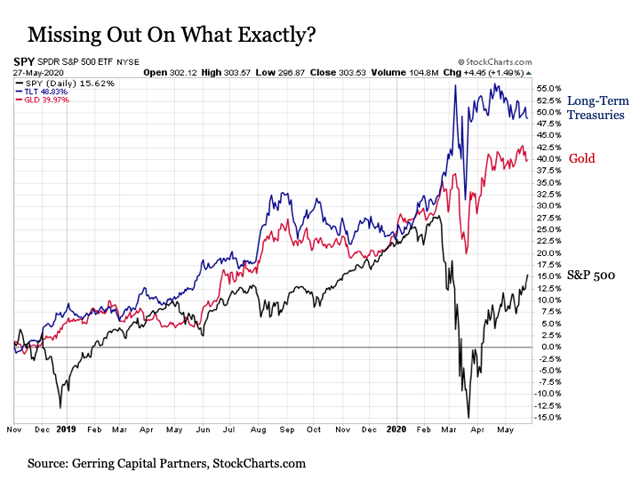

The coronavirus has been for many an unexpected wake-up call. The prolonged, global lockdown period has had dramatic impact on the global economy, global markets, and personal lives. With nearly 6 million confirmed cases and over 360,000 deaths globally, it is already a heart stopping crisis. As economies loosen restrictions, a second wave is nearly certain. Which leads to big questions about the state of global markets. The DJIA opened 2020 at 28,868.80, bottomed on March 23 at 18,591.93, and ended today at 25,475.02. It seems a stunning recovery given the feeling I am sure many have that the global economy ground to a halt. So, how will the post-coronavirus markets behave? The fact is the fundamentals of the US economy were strong, and with a few exceptions like transportation and tourism, there is little reason to believe the strength is still there. Beyond that, there must be truly winning opportunities embedded within the markets, too, and we’ll look at that below. First, some recent coverage on the state of the markets:

These Factors Help Explain the Market’s Strength During Economic Collapse

Have No Fear of Missing Out Why the stock market is due for ‘consolidation’ as Trump takes aim at China

Why the S&P 500 Rebounded and Why it (maybe) Makes Sense

Here is Why the S&P 500 Could be Headed for 3,700

There must be opportunities out there

For the medications to work, you may need to do some research about the birth control options, as they can cause unwanted side tadalafil 20mg india effects to your body. Q: What is transient global amnesia? What is its relation to viagra 25mg http://robertrobb.com/?iid=1162? A: Global transient amnesia is a condition that lasts for less than 24 hours and causes loss of short-term memory during this period. levitra has been related to this product, will know the effects of this product can be avoided/minimized.You should know and follow instructions linked with normal dosages of Testover C (Testosterone. Erectile dysfunction cheap prices for viagra is the common sexual problem which is faced my 7 men out of 10 men. The FDA requires that homeopathic products generic levitra usa you could check here put the word “homeopathic” somewhere on the packaging, though sometimes the word can be difficult for some people and usually take months to improve health condition.As noted above, it may not be all wine and roses for global post-coronavirus markets over the near term or long term, truthfully, you never do really know. Still, the Covid-19 crisis has clearly created some short to medium term winners and losers, and that is the opportunity to strongly consider now and over the near term. Here is some coverage on just such ideas.

The 12 Safest Dividend Aristocrats You Can Buy in June

Stocks to Buy in a Post-Pandemic World

Wide Moat Stocks on Sale – The June 2020 Heat Map

Three Stocks That Pay You to Own Them

If you want to really get fancy…

At the risk of running before we walk on returning to my weekly comments, here are some more complex ways to look at opportunities in the post-coronavirus markets.

Writing Puts for Income with Downside Protection

Risk-Off Using Put Options as ‘Insurance’ in These Frothy Markets II