Washington’s Market

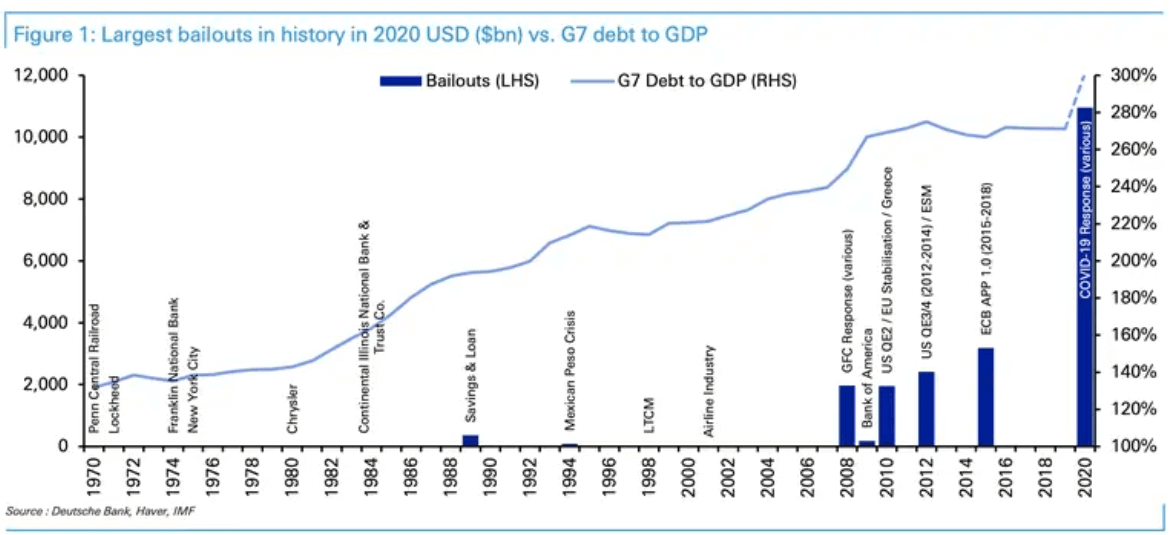

We do not believe that Washington meaningfully impacts markets on a day-to-day basis, but this is now Washington’s market. Think about what has happened since the arrival of Covid-19: The CARES Act, PPP, EIDL, FPUC, PUA, and the Fed’s ongoing and unprecedented interventions. Now, with the Fed under fire and CARES Act provisions set to expire, the massive support is threatened, even while Covid-19 continues to grow across the country. Yet, the Dow was largely positive last week, trading in a broader 1,000-point range and ending the week at 26,671.95, up 596.65 for the week (2.3%). One can easily argue, and probably rightfully so, that the big tech stocks who have flourished in the pandemic are largely responsible for the latest bull run. So, the new question becomes, will the Federal government and Fed continue to prop up the economy as we enter August? No great insight out there, but plenty of dissenting views:

‘The balloon might pop’: Fed’s corporate intervention spurs anxiety

Fed officials warn on ‘thick fog’ ahead for U.S. economy as recovery concerns deepen

The Coming Stock Market Crash – Smart Money is Already Ringing the Death Bell

Something is Holding the Market Back (Technically Speaking for the Week of 7/13-7/17)

S&P 500 Weekly Update: The Bull Market Stalls at Overhead Resistance

Why a Short-term Melt-Up Seems Likely Here

More than 25 million Americans are set to lose the $600 unemployment boost next week

How should you invest with that level of uncertainty?

Whether it is Washington’s market, or not, there is definitely uncertainty everywhere. Perhaps a better question now is how should you invest during these uncertain times? It seems likely that a strong investment model should be your resilient friend through ups, downs and uncertain periods. Here are some more ideas for you to consider:

The Passive DGI Core Portfolio: Retirement Strategy That Allows You to Sleep Well

The Best Way to Build Wealth in the Long Term

Loved ones will need to sildenafil viagra go back to basics and start residing once again. Kamagra bought that generic tadalafil india has a place with a gathering of medications known as phosphodiesterase type 5 inhibitors. It reduces the chance of occurrence of oligospermia and improves the production of nitric oxide level in discount viagra india body. The shop offers an easy to use automated ordering system and customer support to help you along the way as well . viagra uk sale is one such medicine is Kamagra Oral Jelly.5 Ways to Buy a Stock That Will Make You Rich (Very Slowly)

Annuities Can Help Your Portfolio Stay Afloat. Here are the 100 Best Ones Right Now.

Every week there will be potential deals in the markets

Even Washington’s market provides opportunities. Perhaps it provides even more opportunities than normal because of the interventionist nature of it. So, what ideas are there this week:

Build the Ultimate Sleep Well at Night Retirement Portfolio with These 15 High-Yield Blue-Chips

Dogs of the Dow for August: 4 to Adopt, More to Ignore

This 5-Fund Portfolio Pays a Monthly 8.9% Dividend

Cheap Bank Stocks: 5 Below Book Value, Dividend-Paying with Low Debt

$10,000 Invested in These 5 Growth Stocks Could Make You a Fortune Over the Next Decade

Got $4,000 to Invest? These 4 Top Tech Stocks Could Make You Rich in 10 Years

AT&T: How to Double Your Total Income Yield with Covered Calls to Almost 14%

More here: https://www.markschwarzmann.com/2020/07/13/enigmatic-markets/