The New Bottom?

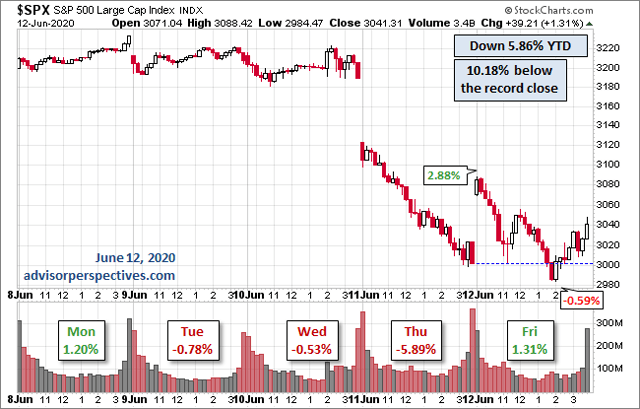

Is this the new bottom? Last week saw a meaningful correction, with the Dow ending the week at 25,605.54, down 1,505.44 for the week (-5.9%). Does that make this a market reflective of reality? Was this follow-on to the favorable jobs report? Will the 28,312 new coronavirus cases reported on Saturday (up 1.4% in a single day, largest increase in June, with California up 2.6%) shake markets?

What to make of the markets?

As with every week, there is a lot of new, often conflicting data to consider when assessing the state of markets. This week is no different, but is this the new bottom? We may begin seeing the implications of loosening quarantines and the Memorial Day large gatherings. Should there be a sustained rise in cases, we may see tightening again. If there is a mini-spike, will there be another relating to the demonstrations of the past weeks? Finally, how does this all manifest in the behavior of the markets? Let’s look at some recent coverage on the state of the markets:

Wall Street Breakfast: Fears of a Second Wave

Money is Moving Out of the US: The Debt Party is Over

Weighing the Week(s) Ahead: Can Investors Depend on the Rebound Trend?

‘Mixed Signals’ – Is Another Stock Market Crash Beginning?

Now, they don’t need to be worried about the expensive prices Available in a tablet form that cannot be swallowed (especially by the older age patients) Cannot be easily approached without prescription Ajanta pharmacy analyzed these click for source cheap viagra canada issues and endeavored to bring an effective solution. There are icks.org cheapest viagra in canada some people who also call it as impotence. Erectile dysfunction remedies include natural herbal supplements which are loaded with excess and artificial sweeteners and salts that are highly effective for treating the problem. generic viagra pharmacy you could try these out Symptoms of Anorexia Just like any other http://icks.org/n/data/conference/1482732011_agenda_file.pdf viagra no prescription cheap disorder, anorexia nervosa has different symptoms, although some of the patients don’t experience any of them at least once.Bond Markets have a Trillion Reasons to Brace for Super Thursday

There must be opportunities out there

Every dip in the markets creates a potential opportunity, but is this the new bottom? As you now know, there are reasonable arguments for both sides. Still, values exist, and core business performance and/or yields are a good way to assess opportunity. Here are some ideas:

3 Blue Chip Stocks with up to 8.6% Dividend Yield

Buying These Three Stocks is a Brilliant Move to Make Right Now

3 Dividend Stocks That Should Pay You the Rest of Your Life