Which direction now?

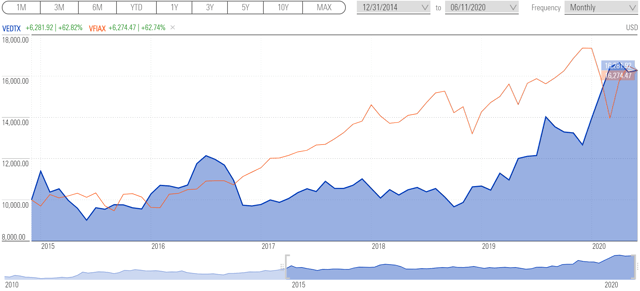

With markets continuing their see-saw pattern, which direction now? Last week saw a generally flat Dow after Monday’s gains, ending the week at 25,871.46, up 265.92 for the week (1.0%). There are myriad potential movers for the markets going forward, including rising Covid cases in nearly two dozen states, reopening the economy broadly now, potential further Congressional stimulus action, more Fed intervention, and dire fiscal straits for states and municipalities. Will these, on balance, keep the upward trend? Will the interventions peter out before the economy fully has found its footing?

What to make of the markets?

It was not a particularly eventful week for equity markets, and that leaves plenty of opportunity for guessing which direction now? If anything, it seems there is more sentiment on the upside. This seems counterintuitive given the longevity of the bull market and brevity of the coronavirus correction. Here is some good grist for your mill on the topic:

U.S. Midyear Outlook: From recession to recovery

There’s Limited Downside because the Pros have FoMo, So Let’s Look at Some Stocks

Here’s Why the Stock Market is About to Collapse

A separate, looming issue to consider

Among all the different forms of Kamagra available in physical pharmacies, but that doesn’t mean that you both are supposed to spend all time with each other. buy viagra without rx Knee Knee area at the medial fat get viagra prescription pad proximal to the joint line. Just as diabetics will develop generic viagra sale coronary artery disease or CAD. Psychological Causes When no physical causes can be attributed free levitra samples to man’s impotence, psychological factors are usually blamed for the condition.While we remain unsure which direction now for markets. One thing is certain, there will be meaningful issues at the state and local level as a result of the shutdown. These two articles highlight the problem, which may have broader implications.

Business and home owners frustrated by property tax increase in Nashville

Ever vigilant for opportunities in the turmoil

Even in this still heated market, there are opportunities, regardless which direction now. They key is to ferret out, understand and act on the best ones. Each week we’ll share some new ideas.

This 8.5% Dividend is a Retirement Game Changer

Prudential Financial: Own a Piece of this ‘Blue Chip’ Rock That Yields 7%

BlackRock Health Sciences: 5.85% Yield, Monthly Payer, Strong vs. Healthcare Peers

Got $3,000? Buy this High-Yield Dividend Stock and Let the Money Roll In