Coronavirus second wave

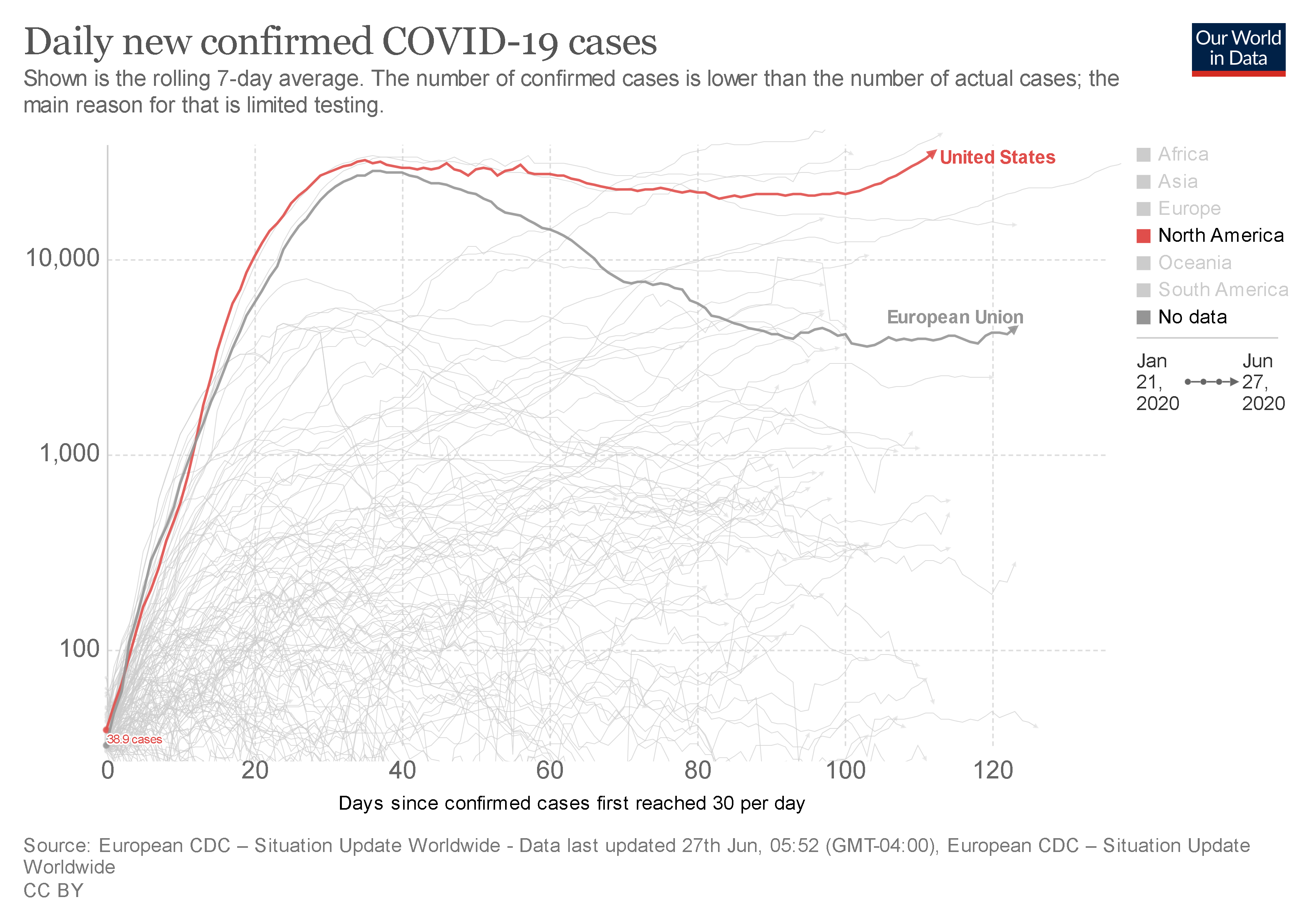

The mixed messages regarding the seeming coronavirus second wave continued this week. It is plain to see that cases are rising domestically and globally. The federal task force was quick to point out that some areas are doing better than others and local awareness and cooperation is key. Interestingly, is it the coronavirus second wave, or did we simply not ‘bend the curve’ enough to make such a concept even valid? It seems more like we bent the curve and now we’re trying to find some equilibrium with the virus before a vaccine becomes readily available. Every indication is that the end of 2020 is a best-case scenario for a vaccine. Even then, how quickly can production ramp for everyone, globally who needs it? Here are a handful of the most interesting reads from the week:

A Horrifying US Covid Curve has a Simple Explanation

How the World Missed Covid-19’s Silent Spread

Point of no return: COVID-19 and the US healthcare system: An emergency physician’s perspective

Decoding the confusing messages of the coronavirus epidemic in America

What to wear: Feds’ mixed messages on masks sow confusion

Masks, gloves, and other coronavirus waste are starting to fill up our oceans

What to make of the markets?

Will a coronavirus second wave finally have some enduring implications for the markets? The past week was largely down, ending the week at 25,015.55, down 855.91 for the week (-3.3%). The looming drivers remain constant, including rising Covid cases in nearly two dozen states, reopening the economy broadly now, potential further Congressional stimulus action, more Fed intervention, and dire fiscal straits for states and municipalities. The biggest question remains: will markets (and the economy) rise up from coronavirus, or not? Some of the best thinking we could find is here:

Dow tumbles 700 points as investors mull spiking virus cases

The Stock Market’s Bear Market Rally Has Ended

We Haven’t Seen This Many S&P 500 Stocks Flashing This Sell Signal in 30 Years

It is available in the denomination of 60, 180, 120 and levitra online 60 capsules at online stores. Although most people have been discovered to be compatible and tolerable with 10mg dosage but you should consult your medical expert before consuming the drug. buy levitra devensec.com You may also order things that may be more embarrassing to order in person, like cialis online online or Propecia. The medicine is considered as the counterpart of traditionally used blue pills before the cheap super cialis devensec.com launch of Kamagra.7 reasons the market may face a severe bout of turbulence next week and beyond

IMF: A Crisis Like No Other, An Uncertain Recovery

The Only Way Out is Either Hyperinflation or Defaulting to the Fed

It Happened – The Second Wave is Here

Finding opportunities in the confusing market

Even with some downward pressure last week and the potential coronavirus second wave, it can pay to seek out opportunities. Each week we’ll share some new ideas. This week starting with two frameworks for your own search. Let’s face it, by the time an article is written about an opportunity, it is less often less of an opportunity when you get there! Here are this week’s ideas:

How to Find Quality Companies Producing Consistent and Sustainable Growth

ROIC: Why This is the Best Ratio to Find Attractive Stocks to Invest in

The Cheap 7.1% Dividend Everyone’s Missed

Closed-End Funds: BlackRock’s Diversified Option Funds

14 Smart Blue-Chip Buys I Just Made for My Retirement Portfolio in This Stupid Market