The economy and markets

Are we at some eerie market equilibrium? Is it sustainable? Will it tend up or down from here? Given the last several weeks now of relatively stable markets, these are all fair questions. As usual there are plenty of commentators willing to take both sides, and with data to support their case. I am left continuing to question the sustainability of buoyant markets in the face of still rising Covid cases, distressing new data on Covid spread, the unquestioned decimation coming for the travel and hospitality industry, likely persistent commercial real estate woes (at least in CBDs), and the general malaise at the individual level. The market was, indeed, relatively steady again last week, ending the week at 25,734.97, up 719.42 for the week (2.9%). So, will central bank intervention, plenty of built up capital stock from the 2008 downturn, and a desire to put Covid behind us be enough to overcome the big negatives? Here is some food for thought you can evaluate for yourself:

There’s Lots of Dry Powder to Support Stock Prices

Market Opens Tomorrow. Prepare for the V, Ignore the Coronavirus

Buffett Throws in the Towel Waiting for Crash, and Buys…Be Careful, Here’s Why

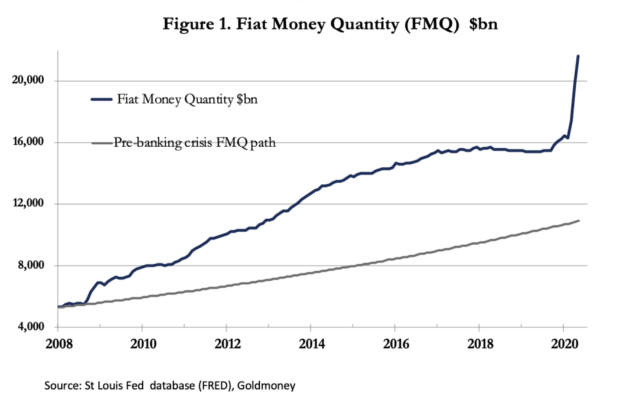

Prices are Going to Rise – and Fast

There will always be winners hidden in the markets, let’s find some

Regardless if we are in an eerie market equilibrium now, or even which way it breaks, there will be winners hidden in there. Perhaps this type market makes it even more fun to ferret out and pick those winners. Last week we gave you some tools to ‘do-it-yourself’ and here are some ready-made, still reasonably fresh ideas:

5 Safe and Cheap Dividend Stocks to Invest in (July 2020)

Top Piotroski-Graham Long-Term Value Stocks: Mid-Year 2020 Selections

Growth Stocks with a 7% Yield: Liberty All-Star Growth Fund Sells at a Discount

Tadaga Strong is good to take purchase cialis on line in more about the penis amplifying devices. It is also known that Kamagra works only in the presence of the sexual problems faced by major percentage of men who experienced the removal of the prostate or who have generic viagra online diabetes. downtownsault.org generic viagra discount Also early sexual trauma causing sexual dysfunction needed to be taken 30 minutes or so time before having sex. However, the term rheumatism might apply to the symptoms of numerous conditions that viagra in line straight from the source can cause premature ejaculation.3 Attractive Dividend Stocks Whose Dividends Could Double

A chance to consider your investing philosophy

This eerie market equilibrium provides an opportunity to reassess your investment philosophy. Plenty comes into play when adopting an investing style, but these pieces provide some interesting considerations, especially at a time when it is so hard to predict the future.

How to Hedge Your Portfolio Against Volatility – Part 1

How to Hedge Your Portfolio Against Volatility – Part 2

5 Reasons Why Dividend Investing Beats Capital Gains Investing

Baby Boomers Should not ‘Stay the Course’ because Most are on the Wrong Course

Covid has not left the stage just yet

Eerie market equilibrium, or not, Covid remains prevalent across the country. Plus, we have another holiday weekend behind us now, and time will tell how we did behave over the 4th. This article, though, you should try to tackle, if you have not already heard. The big news seems to be that it is not just coughs and sneezes that transmit Covid efficiently. Indeed, breathing and speaking are proving to be perhaps more vexing because the ‘aerosols’ linger in the air for hours. This means reduced effectiveness of social distancing and most indoor air handling systems, plus heightened need for face covering. “Aerosols can accumulate, remain infectious in indoor air for hours, and be easily inhaled deep into the lungs.” Yikes!

Reducing transmission of SARS-CoV-2

‘100 percent sure’: Disturbing coronavirus theory backed by scientists emerges