Valuation is the crux of the matter

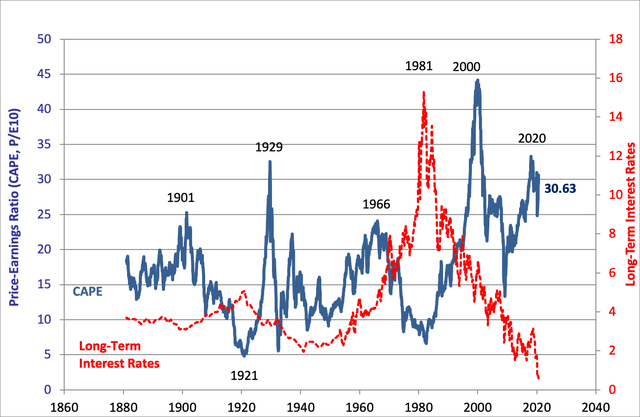

With all the moving parts of the global economy exacerbated by Covid-19, valuation is the fundamental question mark at this time. As you can see from the opening chart, markets have only ever been higher in 1929 and 2000. Is that sustainable in a normal environment? Presumably not. Does it have the legs to survive the end of the global wave of stimulus? Can it be? There are certainly some factors which say yes, but what do you think?

Weekly S&P 500 Chart Storm – Bullish Breadth Breakout

US Stocks are Overvalued: Playing Defense and Offense with Cambria’s Meb Faber

Always looking for value and opportunities to build wealth

Broad market valuation is a big question mark, for sure, but individual issues still present opportunities. Depending upon where you are in your investment cycle, you can play the long game with future stars or the short game with high yield picks. Ultimately, you need to ensure you have what you need for a secure retirement. There is a heavy dose of strategy pieces this week, and if you are looking, some good ideas.

Income Investing

How to Generate 12% in Income, Paid Monthly

Enbridge: You May Regret not Buying This 8.2% Yielder

5 Resilient Low-Risk Dividend Aristocrats for a Volatile Fall

Scotiabank: A 6.4% Yielding Blue Chip Retirees Can Trust

Investment Strategy

Actively Choosing Passive Indexing

How This Income Method Makes You Financially Independent

A Wealth of Relative Value Opportunities in Preferred CEFs

Other Ideas

The Best of the Rest: Top 50 Q3 Stocks Outside S&P 1,500

It never hurts to revisit last week’s ideas:

Valuation, risk, global economies … they all matter

As you look to build your own knowledge of markets, investing, planning for your retirement, and wisely drawing down in retirement, keep adding new skills to your arsenal. This week is a little different than many because it ‘goes big’ with global perspective. Some interesting pieces, though, and a good one on monitoring the overall risk in your investments.

The Sharpe Ratio: Why It’s So Darn Important-And How to Find it for Your Portfolio