Finding long-term value in the market

Finding long-term value is the key to winning in this unpredictable market. There is no clear consensus on the markets, with mostly strong fundamentals, especially earnings and retail sales, and plenty of lingering concerns, like the Covid resurgence and the Presidential election. All this leaves is in the same place as the past several weeks, basically half the prognosticators will ultimately be right. That may be the core problem with a passive, single index based investment approach. Can a diversified passive approach be the best short-term solution by giving offsets to any potential equity correction while retaining long-term value? It is a fair consideration we may take up soon. Until then, here is some comprehensive, multi-perspective analysis for your consideration.

Understanding the Current Market Logic

S&P 500 Weekly Update: Despite Abundant Negativity, the Indices Remain Resilient

Second Covid-19 Wave Hits Europe. What are the Potential Economic Implications?

Business Cycle Indicators: 16 October

Weighing the Week Ahead: Will Strong Earnings Signal an Economic Rebound?

The Big 4: September Retail Sales see All-Time High

Why the Markets Might Rally Right Before the Election

Some potential long-term value plays for your portfolio

Looking for and acting on potential long-term value plays is your best bet today. With the broader direction of markets remaining a mystery, it seems prudent to maintain a diversified strategy and seek out possible ‘winners’ within particular markets. As always we show a bias for income investing since we are hopeful your goal is to provide yourself a secure retirement. Income investing can work in the accumulation phase by consistent reinvestment, building to a greater income stream in retirement.

Income Investing

Dividends First: My Number 1 Secret to Early Retirement

10 Dividend Growth Stocks for October 2020

Finding income and value in preferred securities

The 3 Best High-Yield Dividend Aristocrats

20 Hyper-Growth Blue-Chips Likely to Deliver 22% Annual Returns Over the Next 5 Years

Enbridge is the Best High-Yielding Dividend Stock on the Market

Investment Strategy

The Behavioral Edge in Investing

Other Ideas

Adding NextEra Energy to the Carbon Thesis Portfolio

It never hurts to revisit last week’s ideas:

Building your knowledge each week

If you are not working in the industry or have never actively managed your investments, the notion of finding long-term value might seem foreign to you. That is why each week we put together a collection of articles designed to help you get a good grounding in basic concepts. Combine this with the investment strategy articles usually seen in the section above, and pretty quickly you should begin feeling confident enough to hold a conversation about investing with friends or advisors. You may even venture into your own 401(k) plan, for instance, to see how you are invested, and if you should be changing your investment approach. Those are all good things, and we encourage you to get out there and do it.

Mutual fund vs. ETF: Here’s how these popular investments compare

Dividends First: My Number 1 Secret to Early Retirement

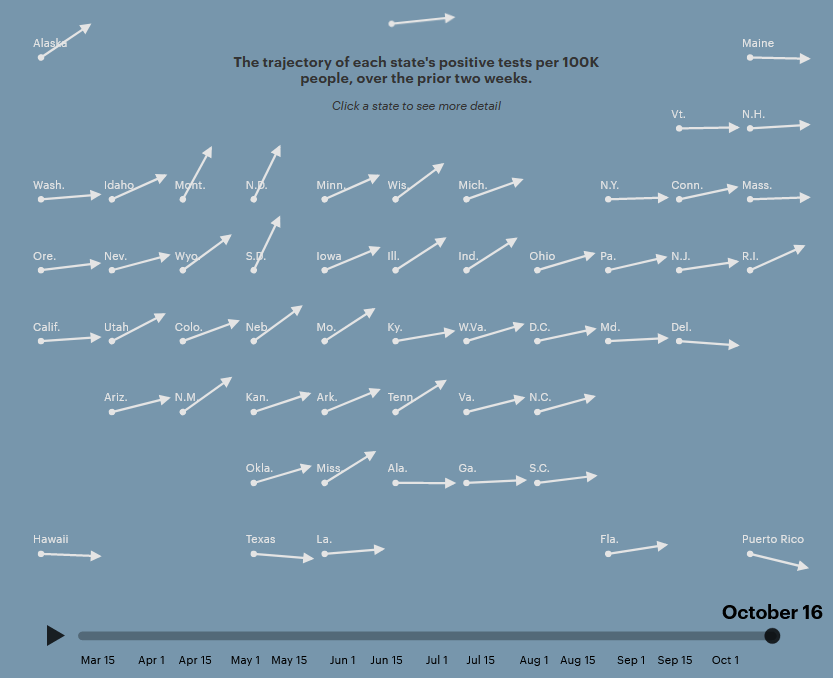

Look for your state on the Covid map here: https://projects.propublica.org/reopening-america/