Markets remain calm, but volatile, and retirement savings continue to erode

Looking beyond the markets this week, we can see that the pandemic is having a lasting impact on American retirement savings. Stripping away the surge in wealth at the very top, America’s most vulnerable will see devastating impacts on their savings. The combination of an uncoordinated Federal response to the virus, ineffective Congressional action, and warning signs that the Fed action is detrimental to middle-class retirement, leaves potentially permanent damage to American’s fiscal health.

Weighing the Week Ahead: What Should Happen and What Will Happen?

The Fed Saved the Economy, but is Threatening Trillions of Dollars’ Worth of Middle-Class Retirement

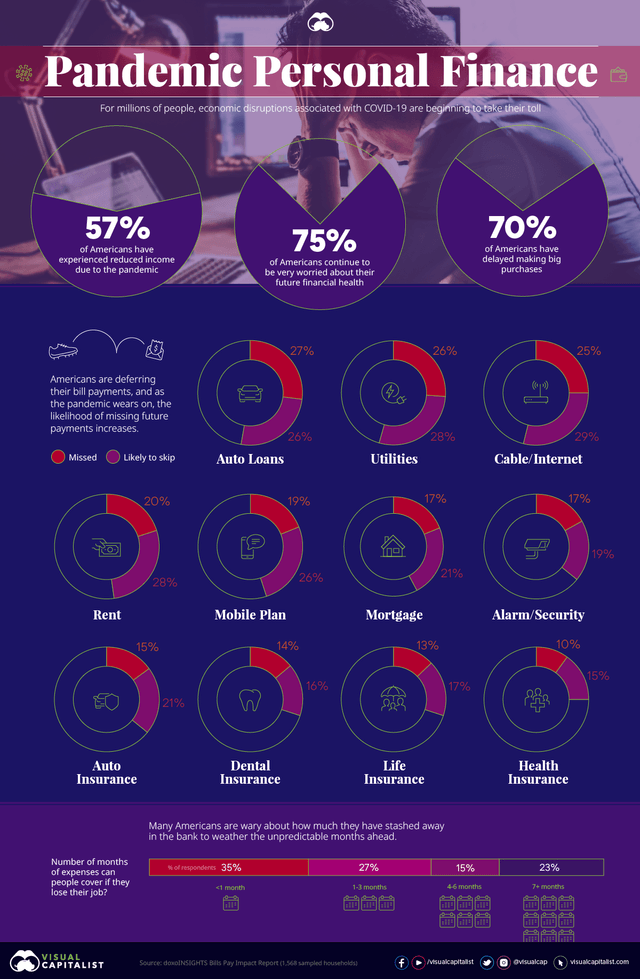

How the Pandemic is Impacting American Wallets

Looking for opportunities in a volatile market

As always, a lot of emphasis on undervalued dividend stocks, but also other ideas that can translate your investable Dollars into retirement savings and retirement income powerhouses. Most everyone should be focusing, to the best of their ability, on preparing for retirement. These ideas may help.

Income Investing

The Most Undervalued and Overvalued Dividend Champions – October 2020

2 “Double-Discounted” Funds Paying 8.7%+ Dividends Monthly

How to Invest $100,000 for $940 a Month in Passive Income

3 Ways Dividend Aristocrats Can Enrich Your Retirement

Found: 17 Reliable, Buyable Dividend Stocks for Retirees in October (of 41)

25 Top Paying Dividend Stocks That Will Make You Rich

Chevron: Solid Cash Flows to Drive Shares Higher

3 No-Brainer Dividend Stocks to Buy Right Now

Other Ideas

4 Unstoppable Stocks to Own in the New Bull Market

ETW: Global Equity Exposure with High Income

Investment Strategy

Time to Abandon the 60/40 Retirement Rule

Retirement Planning

Are You Up for This Lucrative “Retirement Job?”

7 Strategies to Generate Sufficient Cashflow in Retirement

It never hurts to revisit last week’s ideas:

Building your knowledge each week

Retirement savings is the explicit focus this week, but we always try to share some grounding pieces, too, for those who may not live and work in the industry. The hope is that these weekly selections can help build a base of understanding and appreciation for the core concepts that underly the more complex analysis that sometimes resides at the top of the page. There are some particularly fascinating ones this week.

Retirement Strategy: What Does Dividend Growth Investing Really Mean?

Forget Stock Markets – Here’s What Investors Really Should Watch

Want to retire at 62 with $2M? Here’s how much you’ll need to save each month.

The Fed Saved the Economy, but is Threatening Trillions of Dollars’ Worth of Middle-Class Retirement

How the Pandemic is Impacting American Wallets

JP Morgan Veteran Daniel Masters Explains How Blockchain Will End Commercial Banks